Industry new

2024 Global Electric Two-wheeler Market Data and Consumption Report

In just four years, the electric two-wheel market has gone through an up and down process.In 2024, the popularity of electric two-wheelers in the global market continued to rise. According to data from energy giant Eon, nearly a quarter of the German population already owns an electric bicycle, and the ownership rate of electric bicycles among young people has increased significantly. The market share of Belgian electric bicycles exceeded 50% for the first time, surpassing mechanical bicycles. Two-wheel travel products, mainly electric bicycles and electric scooters, are continuously changing people's daily travel methods.

Behind the continuous development of the market, the industry is also facing more challenges. At the beginning of 2024, manufacturers are facing multiple problems such as overproduction, rising costs, inventory backlogs and liquidity. Although the overall market still maintains a demand trend, the entry of a large number of manufacturers has led to oversupply, and the electric two-wheel industry has therefore fallen into a quagmire of high inventory. After a long period of price cuts and promotions, the Ebike industry has gradually escaped from the high inventory. Although the main consumption drivers still exist, sales are expected to stagnate in the medium term. Coupled with economic pressures, changes in consumer habits and changing market dynamics, it poses a challenge to many well-known brands.

So, in this complex market environment, what new changes will occur in the competition landscape? How should enterprises respond? What will be the direction of industrial development and the future scale of the electric two-wheel market? Below I will give you a relatively comprehensive electric two-wheel market data and report.

Table of contents

1. Global electric two-wheel market size and growth trends

2. Main market sales of electric two-wheelers

3. Wave of mergers, acquisitions and restructuring

4. Brand - the future development focus of the enterprise

5. The rise of online sales

6. Consumer Characteristics and Purchasing Preferences

7. Market status of the two-wheel industry

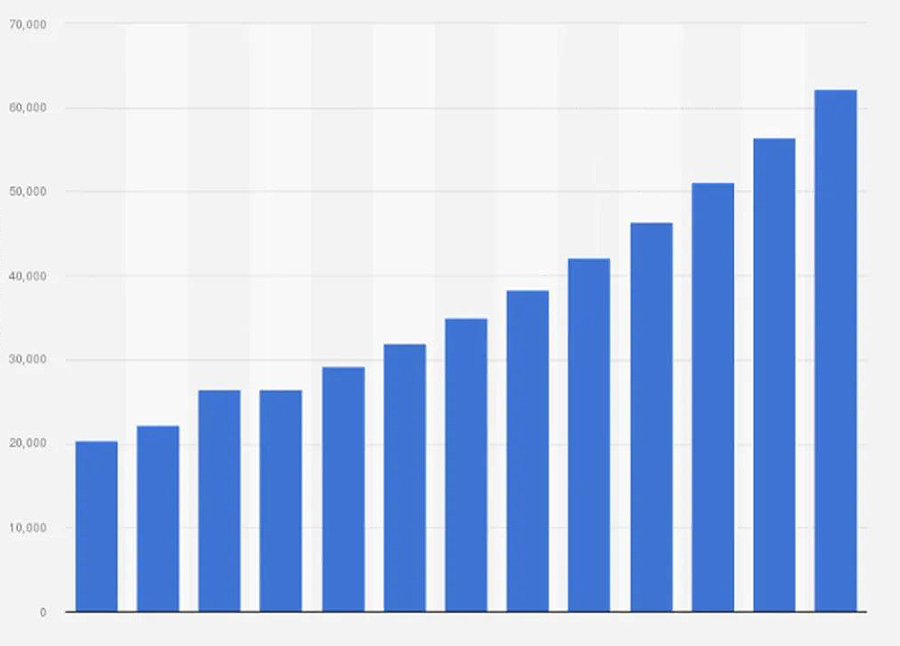

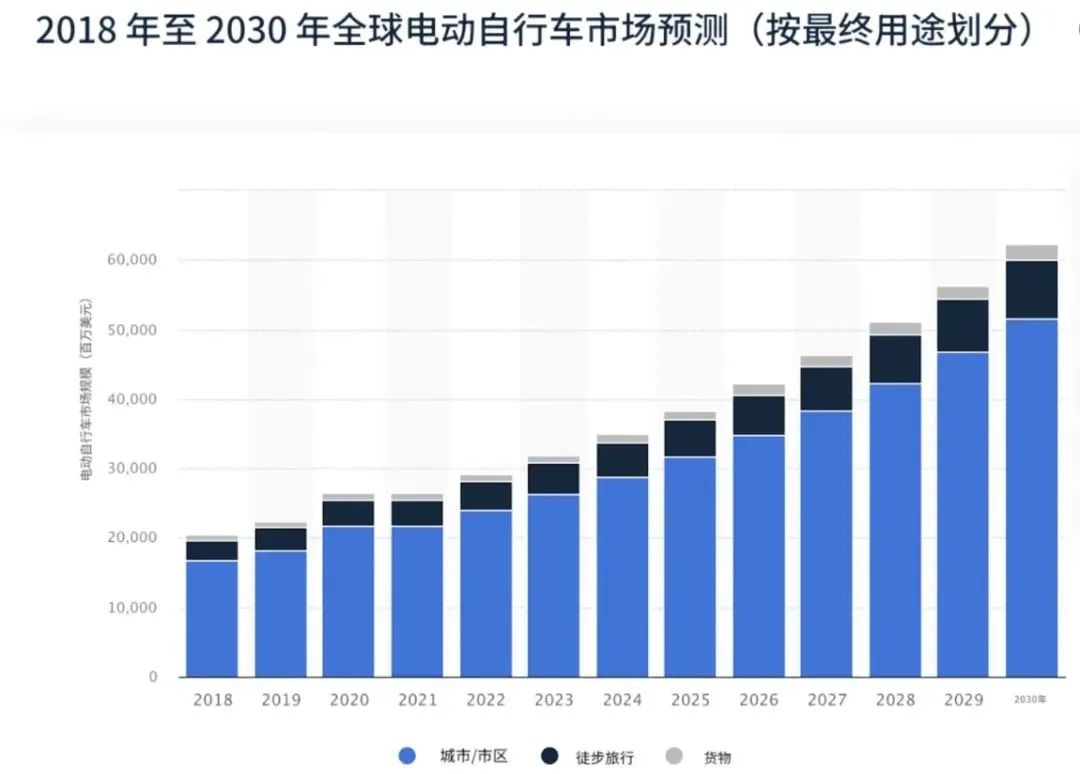

According to Statista data, global electric two-wheel vehicle sales are rising steadily. Although the market potential has not yet been fully released, it is expected that its growth momentum will continue from 2024 to 2030. It is estimated that the global electric bicycle (Ebike) market size will reach US$35 billion in 2024 and is expected to climb to US$62.25 billion by 2030, and will continue to expand at a compound annual growth rate of nearly 10% during this period.

(Data source: Statista)

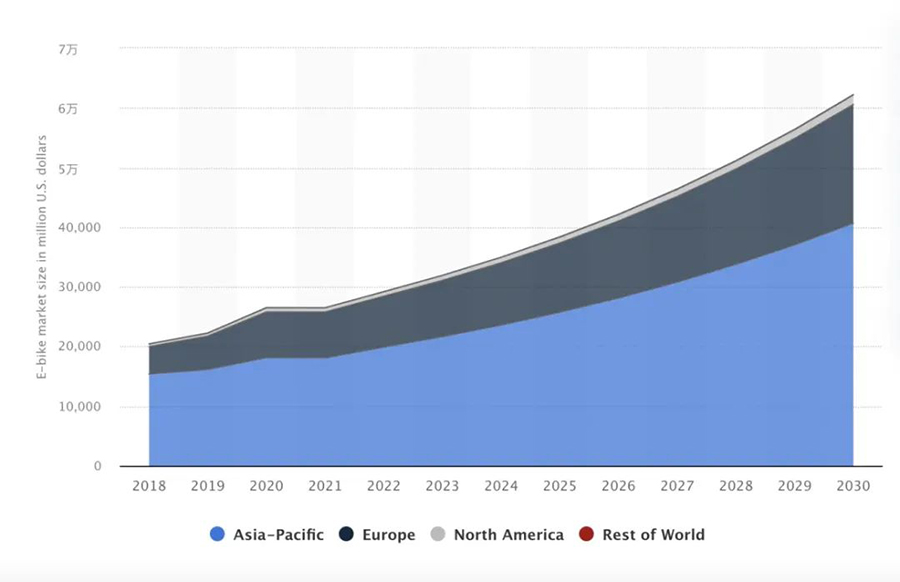

In the global electric two-wheel market, more practical and cost-effective electric two-wheelers are popular in the Asia-Pacific region, while North America and Europe are the main sales bases for electric bicycles (E-Bikes). The Asia-Pacific region accounts for about 63%, followed by Europe (31.4%) and North America (3.9%).

(Data source: Statista)

Asia Pacific has the largest market share, with an estimated market size of $11.97 billion in 2024 and expected to reach $14.67 billion by 2029, with a CAGR of 4.15% during the forecast period (2024-2029). As one of the world's largest electric bicycle markets, Japan, South Korea, India and other countries have shown great development potential. However, Japan's pedal-assisted electric bicycle market is close to saturation.

The European electric bicycle (E-Bike) market remains stable, with growing market acceptance and consumer interest, and a steady increase in penetration.

North America has the fastest growth in electric bicycle sales, with an estimated market size of $3.45 billion in 2024 and expected to surge to $7.54 billion by 2029, with a CAGR of 16.91% during the forecast period (2024-2029). People's increasing awareness of health and environmental protection, the increase in urban traffic congestion, and the expansion of bicycle lane networks have all contributed to the growth of the electric bicycle market. The United States and Canada in particular, although they started from a smaller scale than Europe, are in a stage of rapid growth.

In 2024, despite the overall slump in the global bicycle market, electric bicycles have become a key driver of continued market growth.

Europe: According to Eurostat data, the EU imported 533,000 electric bicycles in the first nine months of 2024. From the quarterly data, the import volume in the third quarter was close to 200,000, which was basically the same as the same period last year. At the same time, as of the end of September, the total import value was 531 million euros.

Among them, Taiwan's exports to Europe remained the leading, but the export volume decreased significantly. In the third quarter of 2024, Taiwan's electric bicycle exports fell 46% from the same period last year. At the same time, mainland China's exports to the EU continued to increase, but the export value did not increase accordingly, and the export unit price may have declined. In the third quarter, the average price of electric bicycles exported from mainland China to the EU was 318 euros, while the average price in Taiwan was 1,391 euros.

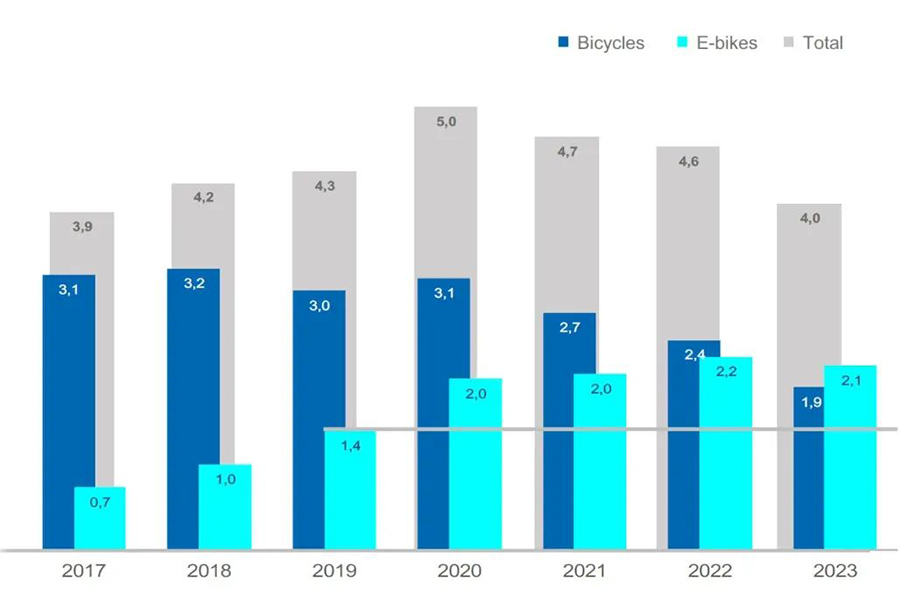

German ZIV data shows that German bicycle sales have fallen by about 19%, but in the first four months of 2024, electric bicycle sales were 800,000, a slight year-on-year decrease of 1.23%, far less than the decline in bicycles. And according to the latest survey by energy giant Eon, the penetration rate of electric bicycles in Germany has reached an average of 24.7%, an increase from 23.3% in 2023.

In addition, from 2016 to 2022, the sales of cargo bicycles in Germany increased from about 15,000 to about 212,800, with an average annual market growth rate of more than 60% in seven years, and it is also one of the fastest growing categories in the German bicycle industry.

(Data source: ZIV)

Overview of the number of bicycles with and without electric assist sold in Germany from 2017 to 2023

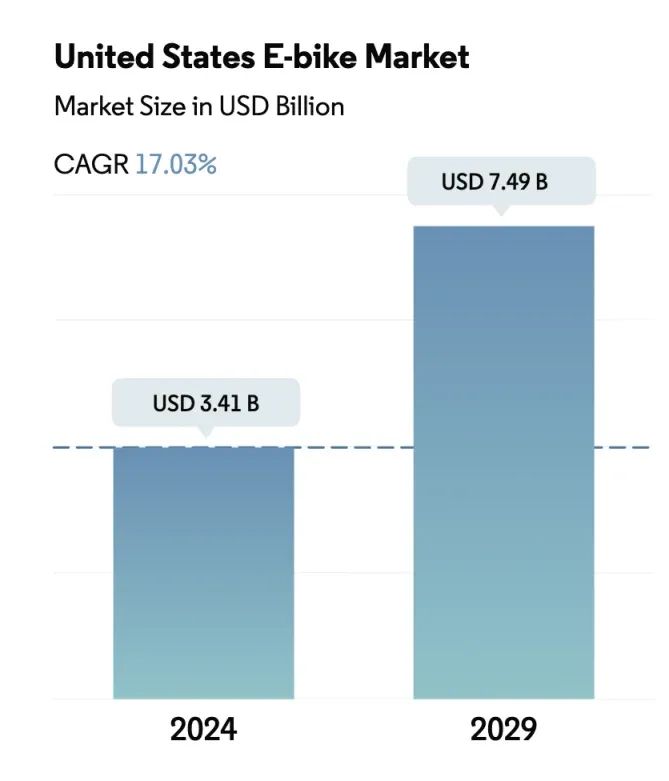

United States: The U.S. electric bicycle market size is expected to be US$3.41 billion in 2024 and is expected to reach US$7.49 billion by 2029, with a compound annual growth rate of 17.03%. The demand for electric bicycles among American consumers is increasing.

(Data source: Mordor Intelligence)

India and Africa: The bicycle markets in other regions develop synchronously. The Indian electric two-wheeler market performed well in 2023, with sales reaching a record high of 857,279 units, a year-on-year increase of 33.5%. The Indian market has a strong demand for electric two-wheelers. South Africa and sub-Saharan Africa are gradually becoming emerging markets for electric two-wheelers. It is predicted that by 2027, the size of the African motorcycle market will grow to US$5.07 billion. As the leading product for sustainable transportation transformation, electric motorcycles are gradually being promoted and applied in this land.

China: China's bicycle exports remain strong, with the number of exports increasing by 19.6% year-on-year to 43.62 million units from January to November 2024, but the average export price has declined. In contrast, the export performance of electric motorcycles and bicycles is stronger, with the number and amount of exports increasing by 45.5% and 26.1% respectively. Although the average export price has also declined, the overall growth momentum remains significant. However, Taiwan's electric bicycle exports fell sharply by 48.95%, and although the average unit price increased by 5.93%, the overall export value still fell by 45.93%.

From the perspective of the global market, the EU and the United States are the main forces in the electric bicycle market, and consumers' demand for environmental protection, health and convenient travel has driven the market to continue to grow. At the same time, China's electric bicycle market has also shown a strong growth momentum, thanks to domestic consumers' pursuit of a healthy life and the government's support for the environmental protection industry. The Southeast Asian two-wheeled electric vehicle market is relatively mature, while the African electric motorcycle market is in the early stages of development and has great potential. Overall, the electric bicycle industry still has a large room for growth and new market opportunities.

In 2024, the European and American bicycle industries are in the midst of a storm of bankruptcy and restructuring. The intensified economic pressure, changes in consumer habits and rapid changes in market dynamics have not spared even well-known Ebike brands.

At the beginning of the year, vanmoof encountered difficulties; recently, well-known Dutch electric bicycle brands Stella and Rocky Mountain Bicycles have filed for bankruptcy; North America's leading Ebike brand Juiced Bikes changed hands for $1.2 million, and Yamaha also announced its withdrawal from the US market. Many bicycle brands have fallen into the quagmire of liquidation, bankruptcy or restructuring.

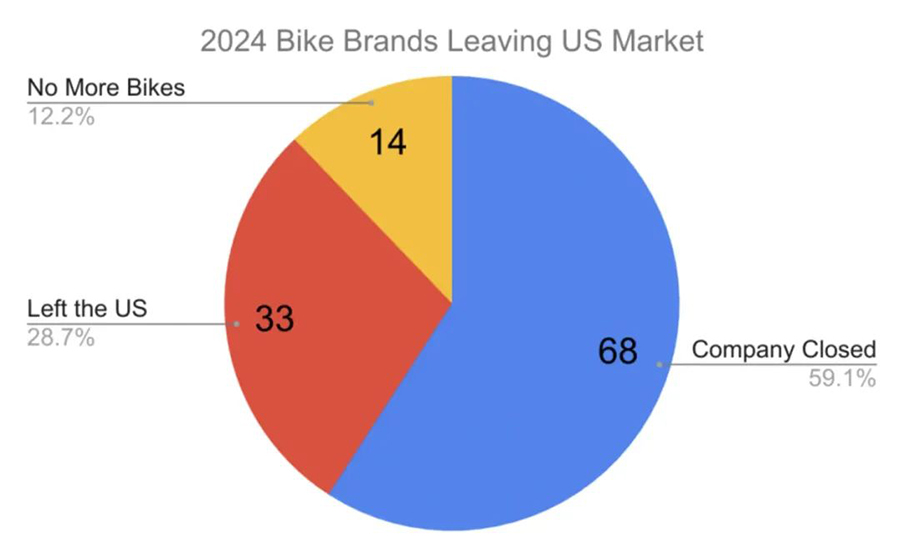

The US market has also been deeply affected. In 2023, 25 brands have closed or withdrawn from the US market. In 2024, affected by the continued deterioration of the market environment, the number of store closures has surged, and a total of 115 brands have withdrawn from the market.

This phenomenon is mainly due to the loss-making promotion strategy adopted by brands to release inventory and reduce costs. Although it has alleviated inventory pressure to a certain extent, it is undoubtedly a fatal blow to small brands with weak financial foundations, making it difficult for them to gain a foothold in the US market. Large organizations can still reorganize to survive, but small brands with low intellectual property awareness have limited options.

In 2024, the global Ebike market entered a stage of rapid integration. After experiencing rapid growth in the past few years, market competition has become increasingly fierce, and differentiation between brands has gradually emerged. Market integration is not only reflected in the reduction in the number of brands, but also in the redistribution of market share. Large enterprises have further consolidated their market position through technological innovation, brand building and channel expansion; while small and medium-sized enterprises face greater survival pressure, and some brands have even withdrawn from the market.

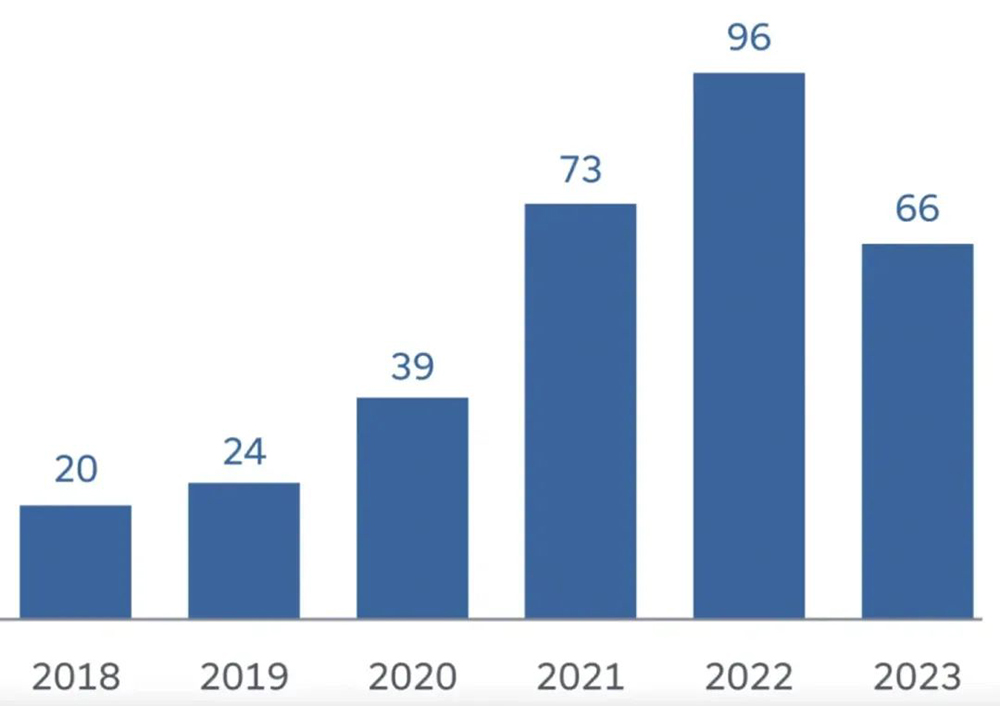

In the later stage of market development, competition between brands has intensified and the speed of market integration has accelerated. Some weaker brands have withdrawn from the market because they cannot adapt to market changes, while stronger brands have expanded their market share by acquiring markets, technologies, and products through mergers and acquisitions, restructuring, etc.

(Number of M&A in the bicycle industry from 2018 to 2023 | Data source: CDN)

In the long run, the Ebike industry still has considerable development prospects, and the industry has great room for growth. At present, the market has not yet produced a global giant brand with absolute dominance. At the consumer level, since the market has not yet formed a strong sense of identity with a certain brand, they are generally more receptive to new brands and new products, which has also attracted more companies to join in. With the influx of more and more market participants, the Ebike market will remain highly competitive for a long time in the future. At the same time, the reorganization and integration of market resources will be accelerated under the survival of the fittest, and mergers and acquisitions will become increasingly frequent. This wave of mergers and acquisitions will further promote changes in the pattern of the Ebike industry and industrial upgrading.

With the maturity and integration of the industry, pure price competition has become difficult to gain a foothold in the market, and brand competition may gradually become the core battlefield for manufacturers to compete. The main driving force for future market growth comes from value rather than sales, and the high added value brought by brand maturity will become the key for manufacturers to obtain a higher profit share.

Market maturity has prompted the entire industry to become more professional, and companies will focus more on improving core capabilities such as brand building, supply chain optimization and profit margin improvement as the focus of future development.

Compared with the past, the path for consumers to purchase products has changed significantly, and the importance of brands has become increasingly prominent. It is not only a display of consumer personality, but also a transmission of brand reputation and strength. With the increase in market participants, bicycle brands have increased their investment in brand building and obtained support through diversified communication channels such as social media, bicycle application platforms, flagship stores and self-operated retail stores. Bicycle companies that successfully shape their brand image will have an advantage in the competition and gradually consolidate their market share.

As the bicycle industry matures, companies are also reducing supply chain risks by moving manufacturing and service operations closer to home. China has historically been the main production location for low-end bicycles, while frames and components for mid-range and high-end models are mostly sourced from mainland China and Taiwan. However, as tensions escalate and governments around the world increasingly scrutinize companies' ESG credentials, brands are seeking to geographically diversify their production layout to reduce their reliance on a single region. For example, Triangle and Carbon Team have established frame production facilities in Portugal, Bianchi has a frame factory in Italy, and Giant has established a production base in Hungary. Advanced Technology has manufacturing capabilities in Germany, while DT Swiss has moved its suspension assembly operations that were originally conducted in Taiwan to a production facility in Poland.

In addition, brands are not only designing frames, but are also beginning to dabble in the design and manufacture of components to capture a higher share of the value chain. For example, Specialized develops its own electronic drivetrains, Scott equips bicycle components through its Syncros brand, and Stromer works with suppliers to develop its own brand of batteries and brake systems. This trend shows that brands are meeting consumer demand for high-quality components by integrating more of their own production components while reducing their reliance on external suppliers.

Bicycle dealers will remain an important sales channel in the future, but 80% of respondents pointed out that brands need to establish or expand direct-to-consumer channels or click-and-collect capabilities to remain competitive. This shift requires brands to increase their level of specialization in marketing, sales, product development, and engineering to adapt to the complexity of the market.

Production planning is a typical example of improved capabilities. Leading players have significantly improved the accuracy of production planning by establishing bottom-up planning processes and strengthening data management and inventory tracking capabilities, making the industry more resilient to market fluctuations. For example, Trek was able to respond quickly to the surge in bicycle demand during COVID-19, thanks to its close ties with the retail industry, which enabled it to quickly obtain supply, while many competitors failed to fully utilize this growth opportunity.

E-Bike (electric bicycle) online sales are gradually becoming a force that cannot be ignored.

The scale of E-Bike in the overseas e-commerce market is gradually increasing. On e-commerce platforms such as Amazon, eBay, Walmart, and TikTok, E-Bike's sales and revenue have increased rapidly year-on-year. Taking the US market as an example, in 2023, the sales of adult electric bicycles on the Amazon platform reached 2.8 billion yuan, a year-on-year growth rate of 57.3%.

Well-known bicycle brands such as Specialized and Trek have begun to try the direct sales model. In the future, e-commerce may go hand in hand with traditional distribution channels and become one of the indispensable sales channels for bicycle brands.

According to the data presented by Bike 24, a well-known German e-commerce platform in the second quarter of 2024, the overall revenue grew by 1.5% to 62.8 million euros, and the revenue increased further in the third quarter, up 2.9% year-on-year to 62.89 million euros. The company's profitability and financial status have both increased, especially in Germany, Austria and Switzerland. From these data, compared with the slow recovery of traditional channels, the growth rate of e-commerce cannot be ignored, and it may even become the focus of major brands.

In contrast, although E-Bike started late in the domestic market, online sales have also achieved significant growth in recent years. In 2023, the sales amount of E-Bike on the mainstream e-commerce platforms in China reached 40.347 million yuan, the number of related discussion topics on major social platforms exceeded 33,000, and the number of interactions reached 5.189 million.

Enterprises have also begun to increase their investment in online sales. According to the public data of cyclingindustry, online stores have become the investment focus of bicycle shops. Driven by the rise of online shopping and e-commerce, the bicycle industry has seen an increasingly broad retail trend. Data from Statista.com shows that the value of British people's online consumption has continued to rise, regardless of the COVID-19 pandemic. In January 2016, the British spent 854 million pounds online. By November, this figure reached 3.1 billion pounds. Against this background, bicycle shops have gradually shifted their sales focus to online channels, choosing to prioritize investment in online store windows to increase online visibility and attract more customers. Similarly, marketing and search engine optimization have also become investment focuses for bicycle shops, which can help increase brand awareness and attract potential customers.

(Data source: Bicycleretailer)

From the perspective of consumer demand, electric bicycles are used in many fields such as transportation, entertainment, fitness and freight. The core users of the Ebike consumer group are cycling enthusiasts, who have high requirements for the performance and cost-effectiveness of electric bicycles and tend to choose electric bicycles with high speed, long endurance and high comfort performance. Among them, the leisure commuting market segment occupies the largest market share. At the same time, with the surge in logistics and freight activities, the demand for electric bicycles in the freight field is also increasing.

(Data source: statistic)

In terms of brand selection, consumers prefer to buy electric bicycles from big brands. In addition to the brand influence of electric bicycles themselves, the brand of their components has also become an important factor affecting consumers' purchasing decisions.

According to Braind's survey, most electric bicycle users believe that the importance of component brands even exceeds the brand of the electric bicycle itself. In addition, the brand and performance of the onboard propulsion system, battery quality, braking system, and anti-theft system are all important reference factors for consumers when choosing products.

The characteristics of consumer groups in different consumer markets also show significant differences.

The majority of American electric bicycle consumers are young people, among whom the 30-39 age group accounts for the highest proportion, reaching 41%, and the 18-26 age group accounts for 30%. The 40-49 age group accounts for 20%, while the 50-64 age group accounts for only 9%. In terms of gender, male consumers dominate, accounting for 68%, while female consumers account for 32%. Most of these consumers come from middle- and high-income families, and about 56% of families have a high annual income and pursue a modern and high-quality lifestyle. However, the low- and mid-end consumer market for electric bicycles in the United States has not yet been fully developed, and there is still broad room for development in the sinking market.

The age distribution of the German electric bicycle market is relatively balanced, with the 30-39 age group accounting for 27%, but affected by the aging trend, the 50-64 age group is the group with the highest ownership rate, accounting for as high as 30%. The gender distribution is also relatively balanced, with male owners accounting for 55% and female owners accounting for 45%, and the proportion of female owners is relatively high. Among them, 48% of electric bicycle users come from high-income families. In Germany, electric bicycles are not only a convenient means of transportation, but also gradually become a symbol of high-quality lifestyle.

The age distribution of French electric bicycle consumers is relatively even, and the overall trend is younger. The 18-39 age group accounts for as high as 54%, of which the 30-39 age group accounts for 29%. In terms of gender, male owners account for 58% and female owners account for 42%. The family income level of French electric bicycle consumers is generally high, 42% of consumers come from high-income families, and 31% belong to middle-income families.

The Dutch electric bicycle market shows a trend of both young and middle-aged groups. The 18-39 age group accounts for 48%, of which the 18-29 young group accounts for 27%; at the same time, the 50-64 middle-aged group accounts for as high as 31%. In terms of gender, men are the main consumer group, accounting for 61%. The family income of Dutch electric bicycle consumers is generally high, 46% of consumers come from high-income families, and 33% belong to middle-income families. These consumer group characteristics provide strong support for the diversified development of the electric bicycle market.

In recent years, the two-wheel market has been undergoing unprecedented changes, among which the tightening of industry supervision, changes in the market trade environment, and uncertainty in policy expectations have become key factors affecting market development.

In terms of industry supervision, governments are gradually strengthening the regulation and management of the electric bicycle market. Take California as an example. The state has officially implemented a new eBike regulation that clearly defines the boundaries between legal and illegal vehicles. The introduction of this regulation not only regulates the advertising, sales and labeling of electric bicycles, but also improves the safety of road traffic.

However, despite the constraints of regulations, there are still many illegal speeding electric bicycles on the road, posing a huge hidden danger to traffic safety. In the UK, the police have stepped up their efforts to investigate and punish illegal vehicles, confiscating nearly a thousand illegal electric bicycles in the past year. At the same time, Super73 Inc. faces prosecution for allegedly selling illegal electric bicycles. New York City has proposed a licensing and registration system for electric bicycles and electric scooters, requiring all vehicles to be licensed and registered with the Ministry of Transportation to further improve the safety and order of road traffic.

In terms of the international trade environment, Europe and the United States have continued to impose sanctions on China's exports. In its 2024 report to Congress, the U.S.-China Economic and Security Review Commission recommended the elimination of the "import threshold exemption", which will prevent products such as electric bicycles and lithium-ion batteries from bypassing safety standards to enter the U.S. market. At the same time, the European Commission is also reviewing anti-dumping tariffs on traditional bicycles from China and extending these measures to key bicycle components. The implementation of these sanctions will undoubtedly increase the export costs and difficulties of Chinese Ebike companies.

In addition, after the new U.S. president takes office, the uncertainty of policy expectations has also become an important factor affecting the development of the Ebike market. President-elect Donald Trump repeatedly mentioned his desire to impose high tariffs on Chinese goods during the campaign, and this policy expectation will undoubtedly increase the competitive pressure on Chinese Ebike companies in the international market. More than 90% of bicycles in the United States come from China, so adjustments to tariff policies will directly affect market supply changes and price systems.

CATEGORIES

LATEST NEWS

CONTACT US

Contact: Jason

Phone: +86 13815000005

Tel: +86 13861005608

Email: info@naicisports.com

Whatsapp: +86 13815000005

Add: furong shuangmiao, hengshan bridge town, wujin district, changzhou city.

info

info

+86 13815000005

+86 13815000005